It has been reported by the land registry that house prices rose around 9.9% year on year back in September. However, there were also stark warning signs that the housing market was beginning to slow and would soon fall off a very sharp peak.

Due to the quick and frequent changes in government and legislation over the last few months, the UK housing market is slowing down and will likely come to a standstill while the cost of living crisis pans out. With interest rates fluctuating daily and by quite a lot at a time, it is almost impossible for mortgage brokers to find the best mortgages for their clients and estate agents to find people looking to buy property.

Experts across the country are anticipating much more significant price drops in the housing market over the next year as the cost of living crisis continues to ravage the country, but what does this mean for the entire housing market in the UK?

We have written this article at Miles Byron to help you understand the housing market changes and their effect on the country’s economy. If you have any questions or queries, be sure to reach out to our team, we are always more than happy to help you in any way we can.

Have House Prices Changed Over Time?

Absolutely! Average house prices have risen a lot over the last couple of years; this is in line with the global pandemic, stamp duty holidays and other costs of living issues that have brought a much more volatile market to the front of our housing market.

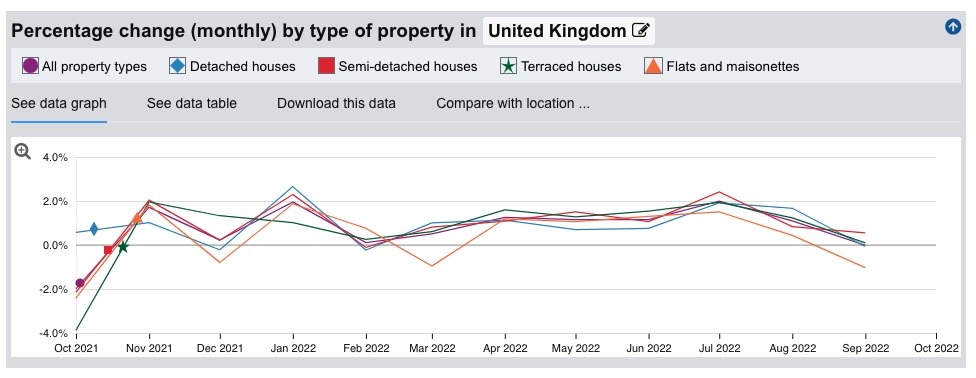

Using the Land Registry’s UK House Price Index, we can look at the statistic of all house prices across the UK, and it is one of the most reliable graphs that displays what is happening to house prices in the UK. You can see in the graph we have attached below that the house prices month on month from December 2021 through the day of writing fluctuate in a downward pattern. The housing market is crashing.

Statistics from the Land Registry say that average house prices in the UK rose by 9.5% year on year from September, reaching around £294,559. Looking at this figure, you would assume the housing market is strong, but it quickly becomes distorted in early 2021, with issues such as the stamp duty holiday not being considered. This means homeowners could buy a home and save up to £2,500 if they did so before the 30th of September in 2021.

It is always difficult to find statistics that are true to the period they are suggested; this is because, as you can see in the graph below, the percentage change in house prices fluctuated a lot throughout last year and has started to decline quite rapidly. The housing market is currently an extremely volatile place.

How Many Homes Are Being Sold In The UK?

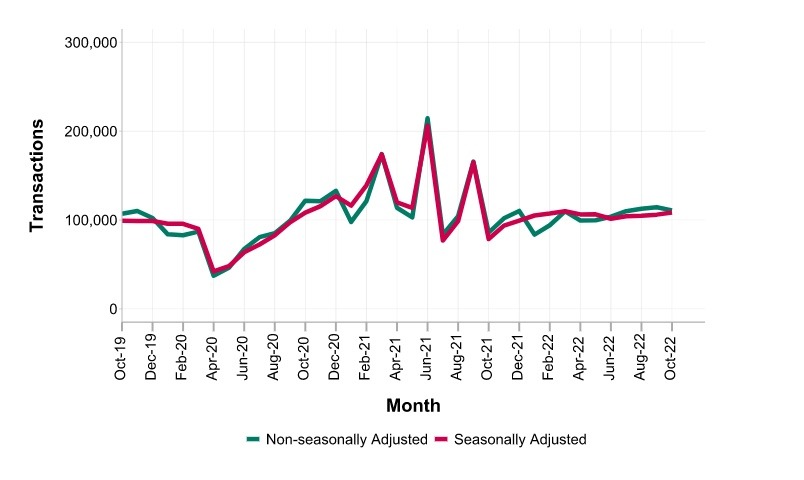

This one is difficult to quantify because the data only currently runs from October 2021 to October 2022, so it is not quite up-to-date in the months. However, the housing market generally needs to catch up in reports.

Across 2021, the property market blew up due to the number of buyers that rushed to the market to benefit from the Stamp Duty cut that had been put in place temporarily. The deadline for this meant there was a massive spike in house sales through June and July 2021; during this time, tax savings of up to £15,000 were available for people to benefit from.

The number of houses bought now is much closer to the rates they were back before the global pandemic, with the most recent statistics from HMRC.

Has The Housing Market Slowed Down?

During the first six months of 2022, there was an issue between supply and demand; there were simply not enough properties coming on the market for the number of homeowners looking to buy, causing a stark imbalance across the entire housing market.

This imbalance hasn’t disappeared yet in the second half of the year, it is specific to locations up and down the country, but on the other hand, there is a clear line that states the demand for properties around the entire UK has started to drop.

The demand is reducing slowly, but the reduction is there, is noticeable and will have an impact on the UK’s housing market as a whole.

What Is The Forecast For The Rest Of The Year?

Experts within the housing market are predicting that for the rest of the year, the housing market will continue to slow; this comes at the hand of the cost of living crisis, rising interest rates and rising mortgage rates, all of which will affect the number of properties being sold around the UK.

It is a much more complicated task to predict a longer-term image; earlier in the year, the experts suggested a smooth, consistent market for 2023, but with the current climate, there is far too much uncertainty in the market, the government mini-budgets have left experts feeling confused and unsure on the future market for the following year.

It is possible that house prices could drop by as much as 5% in 2023, with some experts suggesting this could be as much as 12% into 2024!

Is It Possible To Get A Mortgage Deal At This Time?

There is so much uncertainty around the market when it comes to mortgages. This has only been fuelled by lenders withdrawing deals and mortgages from hundreds of different accounts; this followed September’s mini-budget.

With the cheapest mortgage rate being below 1% earlier in the year, they are now sitting around 5%, paired with the Bank of England increasing its rate to 3%; there is just a lot of uncertainty around mortgages.

You need to speak to your mortgage advisor to find out what they can offer you; whether you are looking to buy and need a first-time buyer’s mortgage, you need to remortgage or anything else, be sure to get in touch with Miles Byron. We are always more than happy to help in any way we can.